Black Banx Uses Crypto to Help Customers With Their Financial Futures

As digital banking has moved on from novelty to daily essential, cryptocurrency has emerged as a powerful tool for those looking to take control of their financial futures. However, diving into the world of digital assets can be daunting for the uninitiated.

This has been where Black Banx, a Toronto-based global digital banking company, comes into play. Founded in 2014 by German billionaire Michael Gastauer, Black Banx has made it its mission to bridge the gap between traditional and digital finance.

By seamlessly integrating cryptocurrencies into their platform, Black Banx empowers customers—both seasoned investors and newcomers alike—to navigate the complex world of crypto with confidence and ease.

The Rise of Cryptocurrency: A New Financial Frontier

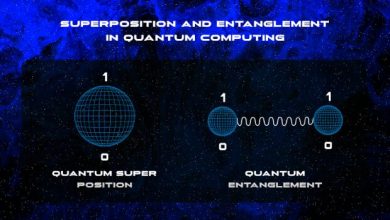

Cryptocurrency has revolutionized the way we think about money. What started as an obscure experiment with Bitcoin in 2009 has transformed into a mainstream financial instrument that is reshaping global finance. The appeal of cryptocurrencies lies in their decentralization, security, and potential for high returns. However, the crypto market isn’t without its challenges, including regulatory scrutiny, market volatility, and security concerns.

Black Banx recognized the transformative potential of cryptocurrencies early on. By 2016, just two years after its inception, the company introduced cryptocurrency as a deposit method, setting the stage for its future as a leader in digital finance. Today, Black Banx offers a comprehensive suite of cryptocurrency services designed to help customers manage their digital assets while seamlessly integrating them with traditional financial tools.

A Journey into Cryptocurrency with Black Banx

Black Banx’s journey into cryptocurrency is nothing short of remarkable. The company’s initial focus was on revolutionizing traditional banking by offering instant account opening and global real-time fund transfers. This innovative approach quickly attracted over 200,000 customers within its first year. By 2016, Black Banx had already begun offering cryptocurrency as a deposit option, which significantly boosted its customer base to 1 million by the end of that year.

The following years saw Black Banx expanding its operations globally, opening offices in key markets like Singapore, Brazil, India, and Russia. By 2018, Black Banx had launched full-fledged cryptocurrency trading services, initially supporting Bitcoin (BTC) and Ethereum (ETH). This strategic expansion contributed to a staggering valuation of US$9.8 billion, making Black Banx one of Europe’s most valuable fintech companies.

Empowering Customers Through Comprehensive Crypto Services

One of Black Banx’s key strengths lies in its ability to offer a wide range of cryptocurrency services that cater to both individual and business clients. Here’s a closer look at what Black Banx offers:

- Multi-Currency Accounts: Customers can hold accounts in 28 fiat currencies and two cryptocurrencies.

- Real-Time Currency Exchange: The platform provides real-time exchange services, allowing seamless conversions between fiat and cryptocurrencies.

- Crypto Trading: Besides Bitcoin and Ethereum, customers can trade USDT and enjoy quick transactions using networks like Solana, Lightning Network, and Tron/TRC20.

- Debit Card Options: Black Banx offers multi-currency debit cards (plastic, metal, and virtual), making it easy for customers to access and spend their crypto funds.

- Interest-Bearing Savings Accounts: Customers can earn interest on their savings in major fiat currencies.

- Bulk Payments for Businesses: Solutions like batch upload or API for bulk payments streamline business operations.

This comprehensive offering allows customers to manage their finances holistically, combining the benefits of traditional banking with the flexibility and potential of cryptocurrencies.

Revolutionizing Cross-Border Payments

One of the standout features of Black Banx’s crypto integration is its impact on cross-border payments. Traditionally, international money transfers have been slow and expensive, often involving multiple intermediaries and high fees. Black Banx has disrupted this model by leveraging local real-time settlement systems across various countries. This approach enables quick, cost-effective international money transfers, setting a new standard in the industry.

Black Banx’s ability to connect traditional and digital finance through its platform is particularly beneficial for businesses operating in multiple countries. By offering seamless conversions between fiat and cryptocurrencies, Black Banx makes it easier for businesses to manage their finances, pay suppliers, and receive payments from customers, all while minimizing currency conversion costs and delays.

Promoting Financial Inclusion

Michael Gastauer, the visionary behind Black Banx, has always been committed to promoting financial inclusion. Black Banx’s efforts to provide essential financial tools to the unbanked and underbanked populations around the world are a testament to this commitment. By offering a platform that integrates traditional and digital finance, Black Banx is helping to bridge the gap between these populations and the global financial system.

This focus on financial inclusion is particularly evident in Black Banx’s operations in underbanked regions. By making cross-border transactions as simple and seamless as local transactions, Black Banx is opening up new economic opportunities for individuals and businesses in these regions. The company’s dedication to educating its customers about cryptocurrencies also ensures that even those who are new to the digital finance world can make informed decisions and take advantage of the opportunities that cryptocurrencies offer.

A Strong Financial Performance

Black Banx’s financial performance in recent years underscores the success of its innovative approach to digital banking. In 2023, the company generated US$2.3 billion in revenue, marking a 109% year-on-year increase. The pre-tax profit stood at US$289 million, up 62% from the previous year. This growth trajectory continued into 2024, with Black Banx reporting a profit before tax of US$761 million for the second quarter alone, and US$1.4 billion for the first half of the year.

This impressive financial performance is driven by several factors, including the company’s ability to attract new customers, its strategic investments in technology and infrastructure, and the introduction of fixed monthly account maintenance fees. With a customer base that has grown to 52 million by mid-2024, Black Banx is well-positioned to continue its growth and maintain its status as a leader in the digital banking industry.

Commitment to Security and Compliance

In digital finance, security and compliance are paramount. Black Banx takes these responsibilities seriously, implementing robust security measures to protect its customers’ assets and data. The use of blockchain technology adds an additional layer of security, ensuring that transactions are transparent, immutable, and resistant to fraud.

Black Banx also ensures it always adheres to stringent regulatory standards to ensure compliance with international financial laws. The company is fully PCI DSS 3.2-certified and complies with the highest Data Security Standards. Its servers are located in ISO-certified Data Centers, and its payment software uses fully encrypted and secured ISO 20022-certified messaging schemes for payment execution and data transfers. These measures not only protect customers but also build trust in Black Banx’s platform, making it a reliable choice for managing digital assets.

As the company continues to grow and expand its offerings, it remains committed to its core values of innovation, security, and customer empowerment. With a strong financial performance and a clear vision for the future, Black Banx is well on its way to leading the next generation of digital banking. Whether you’re a seasoned investor or a newcomer to the world of crypto, Black Banx provides the tools and resources you need to navigate the financial landscape with confidence.

Read More From Techbullion And Businesnewswire.com